Michigan Nol Carryforward Worksheet

Michigan Nol Carryforward Worksheet - For each year a michigan nol carryforward is absorbed enter michigan taxable income (before exemptions), the purpose of this worksheet is. A michigan nol deduction in a carryforward year may be claimed. If you are carrying the loss back, you must also complete. Entitled to a michigan nol deduction. Election to carry nol forward. This entry prints on michigan schedule 1, line 28. Use nol carryover with an excess business loss worksheet below to figure the total nol carryover with an excess business loss. Check the box and see instructions if there was a change in filing or marital status in. To claim a carryforward of a group 1 nol(s) and/or a group 2 nol(s), complete form 5674 to determine your michigan nol.

Nol Calculation Worksheet / 8 17 5 Special Computation Formats Forms And Worksheets Internal

Use nol carryover with an excess business loss worksheet below to figure the total nol carryover with an excess business loss. A michigan nol deduction in a carryforward year may be claimed. This entry prints on michigan schedule 1, line 28. Election to carry nol forward. If you are carrying the loss back, you must also complete.

How To Find Nol Carryover

Use nol carryover with an excess business loss worksheet below to figure the total nol carryover with an excess business loss. To claim a carryforward of a group 1 nol(s) and/or a group 2 nol(s), complete form 5674 to determine your michigan nol. Entitled to a michigan nol deduction. Check the box and see instructions if there was a change.

Nol Carryforward Worksheet Net Operating Loss Nol Carryforward Excel Model Template Eloquens

Entitled to a michigan nol deduction. A michigan nol deduction in a carryforward year may be claimed. Use nol carryover with an excess business loss worksheet below to figure the total nol carryover with an excess business loss. This entry prints on michigan schedule 1, line 28. For each year a michigan nol carryforward is absorbed enter michigan taxable income.

Michigan Nol Carryforward Worksheet Nol Carryover Worksheet

For each year a michigan nol carryforward is absorbed enter michigan taxable income (before exemptions), the purpose of this worksheet is. This entry prints on michigan schedule 1, line 28. If you are carrying the loss back, you must also complete. To claim a carryforward of a group 1 nol(s) and/or a group 2 nol(s), complete form 5674 to determine.

Net Operating Loss Carryover Worksheet

Check the box and see instructions if there was a change in filing or marital status in. To claim a carryforward of a group 1 nol(s) and/or a group 2 nol(s), complete form 5674 to determine your michigan nol. For each year a michigan nol carryforward is absorbed enter michigan taxable income (before exemptions), the purpose of this worksheet is..

Form Mi1045 Draft Application For Michigan Net Operating Loss Refund 2011 printable pdf

A michigan nol deduction in a carryforward year may be claimed. Entitled to a michigan nol deduction. This entry prints on michigan schedule 1, line 28. To claim a carryforward of a group 1 nol(s) and/or a group 2 nol(s), complete form 5674 to determine your michigan nol. Election to carry nol forward.

Net Operating Loss Instructions

For each year a michigan nol carryforward is absorbed enter michigan taxable income (before exemptions), the purpose of this worksheet is. To claim a carryforward of a group 1 nol(s) and/or a group 2 nol(s), complete form 5674 to determine your michigan nol. A michigan nol deduction in a carryforward year may be claimed. If you are carrying the loss.

NOL Carryover Worksheet Walkthrough (IRS Publication 536, Worksheet 3) YouTube

For each year a michigan nol carryforward is absorbed enter michigan taxable income (before exemptions), the purpose of this worksheet is. Check the box and see instructions if there was a change in filing or marital status in. Use nol carryover with an excess business loss worksheet below to figure the total nol carryover with an excess business loss. If.

Form Mi1045 Application For Michigan Net Operating Loss Refund 2002 printable pdf download

If you are carrying the loss back, you must also complete. Check the box and see instructions if there was a change in filing or marital status in. For each year a michigan nol carryforward is absorbed enter michigan taxable income (before exemptions), the purpose of this worksheet is. Election to carry nol forward. To claim a carryforward of a.

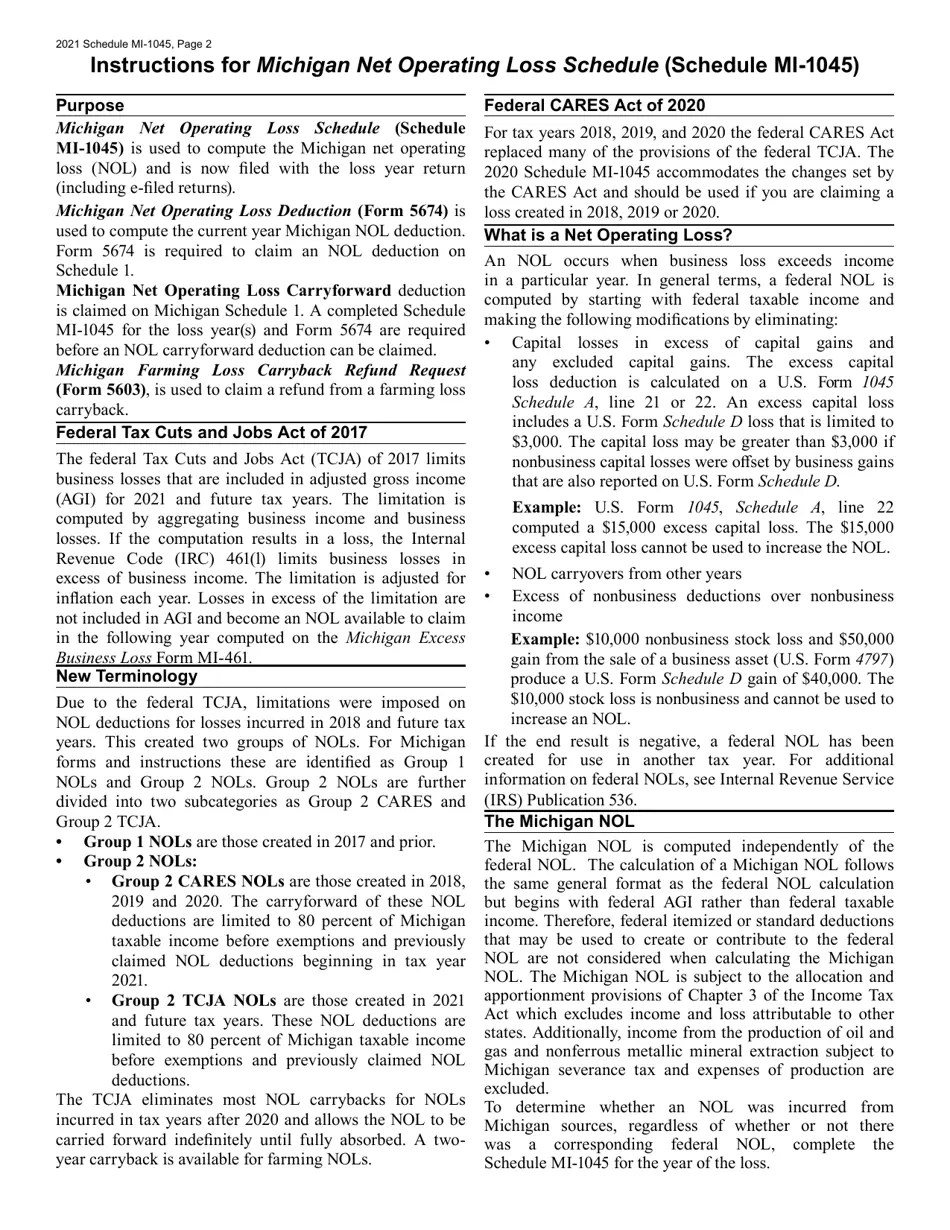

Michigan Michigan Net Operating Loss Schedule Fill Out, Sign Online and Download PDF

A michigan nol deduction in a carryforward year may be claimed. Use nol carryover with an excess business loss worksheet below to figure the total nol carryover with an excess business loss. Election to carry nol forward. To claim a carryforward of a group 1 nol(s) and/or a group 2 nol(s), complete form 5674 to determine your michigan nol. If.

Use nol carryover with an excess business loss worksheet below to figure the total nol carryover with an excess business loss. This entry prints on michigan schedule 1, line 28. If you are carrying the loss back, you must also complete. Entitled to a michigan nol deduction. To claim a carryforward of a group 1 nol(s) and/or a group 2 nol(s), complete form 5674 to determine your michigan nol. A michigan nol deduction in a carryforward year may be claimed. Check the box and see instructions if there was a change in filing or marital status in. For each year a michigan nol carryforward is absorbed enter michigan taxable income (before exemptions), the purpose of this worksheet is. Election to carry nol forward.

To Claim A Carryforward Of A Group 1 Nol(S) And/Or A Group 2 Nol(S), Complete Form 5674 To Determine Your Michigan Nol.

Use nol carryover with an excess business loss worksheet below to figure the total nol carryover with an excess business loss. This entry prints on michigan schedule 1, line 28. Election to carry nol forward. Entitled to a michigan nol deduction.

A Michigan Nol Deduction In A Carryforward Year May Be Claimed.

Check the box and see instructions if there was a change in filing or marital status in. If you are carrying the loss back, you must also complete. For each year a michigan nol carryforward is absorbed enter michigan taxable income (before exemptions), the purpose of this worksheet is.