Like Kind Exchange Worksheet

Like Kind Exchange Worksheet - Use part iii to figure the amount of gain required to be reported on the tax return in the current year if cash or property. Use parts i, ii, and iii of form 8824 to report each exchange of business or investment real property for real property of a like kind. How do we report the exchange? This 1031 calculator is the same tool our experts use to calculate deferrable taxes when selling a. The form 8824 is divided into three. If the property described on line 1. Download the free like kind exchange worksheet. The form 8824 is divided into four. See an example scenario and download the form and instructions from the irs. Only real property should be described on lines 1 and 2.

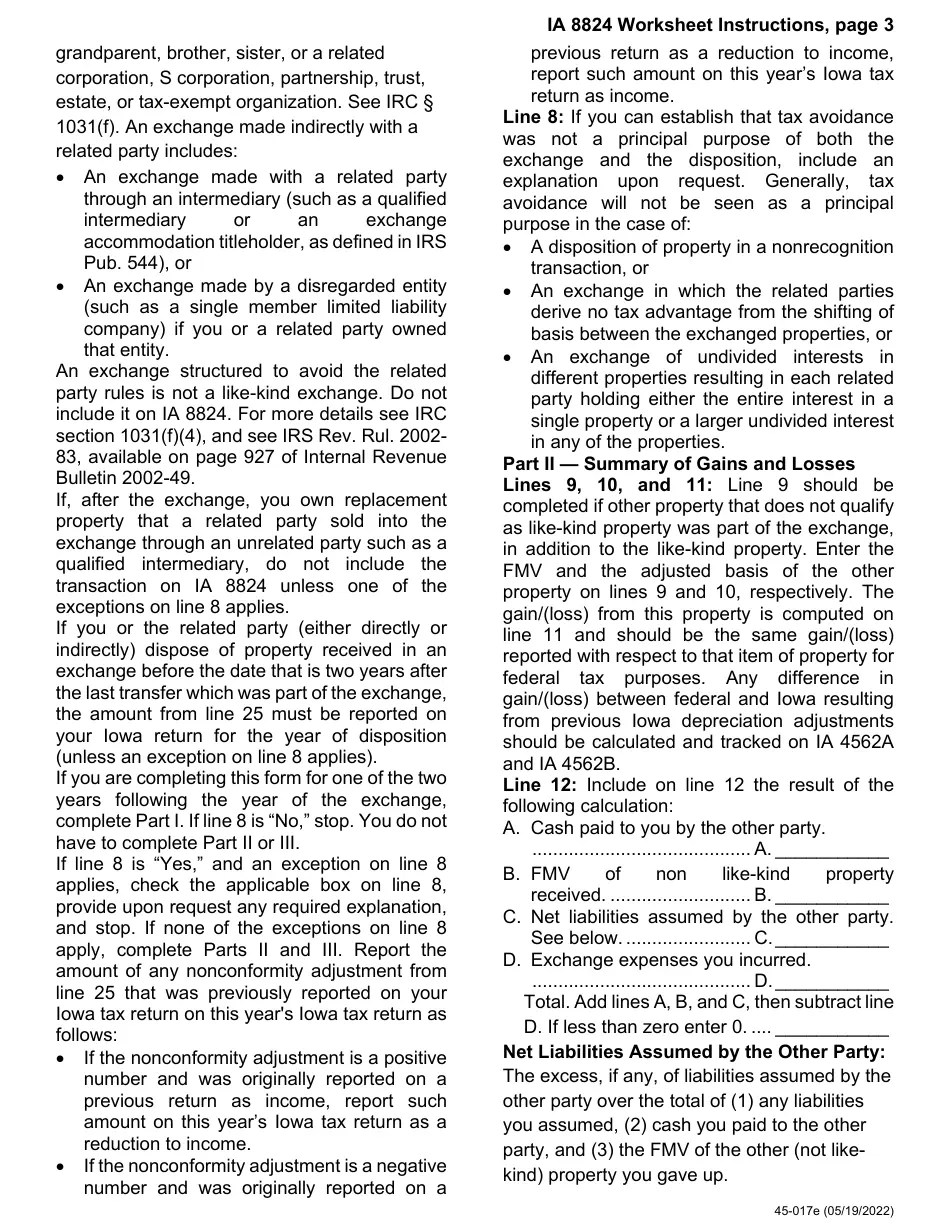

IRS Form 8824 Instructions LikeKind Exchanges

If the property described on line 1. See an example scenario and download the form and instructions from the irs. This 1031 calculator is the same tool our experts use to calculate deferrable taxes when selling a. How do we report the exchange? The form 8824 is divided into four.

Fillable Online LIKEKIND EXCHANGE WORKSHEET Fax Email Print pdfFiller

Only real property should be described on lines 1 and 2. If the property described on line 1. The form 8824 is divided into three. How do we report the exchange? The form 8824 is divided into four.

Form IA8824 (45017) Fill Out, Sign Online and Download Printable PDF, Iowa Templateroller

How do we report the exchange? Use part iii to figure the amount of gain required to be reported on the tax return in the current year if cash or property. This 1031 calculator is the same tool our experts use to calculate deferrable taxes when selling a. Download the free like kind exchange worksheet. Only real property should be.

Like Kind Exchange Worksheet The Math Worksheets

See an example scenario and download the form and instructions from the irs. Use part iii to figure the amount of gain required to be reported on the tax return in the current year if cash or property. Only real property should be described on lines 1 and 2. If the property described on line 1. Use parts i, ii,.

Like Kind Exchange Worksheet The Math Worksheets

If the property described on line 1. See an example scenario and download the form and instructions from the irs. The form 8824 is divided into four. The form 8824 is divided into three. How do we report the exchange?

Form 8824 LikeKind Exchanges (2015) Free Download

See an example scenario and download the form and instructions from the irs. Download the free like kind exchange worksheet. How do we report the exchange? The form 8824 is divided into three. The form 8824 is divided into four.

8824 LikeKind Exchanges UltimateTax Solution Center

The form 8824 is divided into four. This 1031 calculator is the same tool our experts use to calculate deferrable taxes when selling a. If the property described on line 1. Only real property should be described on lines 1 and 2. Download the free like kind exchange worksheet.

Like Kind Exchange Worksheet —

If the property described on line 1. See an example scenario and download the form and instructions from the irs. Use parts i, ii, and iii of form 8824 to report each exchange of business or investment real property for real property of a like kind. Only real property should be described on lines 1 and 2. Use part iii.

Form IA8824 (45017) Download Printable PDF or Fill Online LikeKind Exchange of Personal

How do we report the exchange? Only real property should be described on lines 1 and 2. This 1031 calculator is the same tool our experts use to calculate deferrable taxes when selling a. If the property described on line 1. The form 8824 is divided into four.

Instructions For Form 8824 LikeKind Exchanges (And Section 1043 ConflictOfInterest Sales

If the property described on line 1. This 1031 calculator is the same tool our experts use to calculate deferrable taxes when selling a. How do we report the exchange? The form 8824 is divided into three. How do we report the exchange?

The form 8824 is divided into four. Use part iii to figure the amount of gain required to be reported on the tax return in the current year if cash or property. Only real property should be described on lines 1 and 2. Use parts i, ii, and iii of form 8824 to report each exchange of business or investment real property for real property of a like kind. If the property described on line 1. See an example scenario and download the form and instructions from the irs. The form 8824 is divided into three. This 1031 calculator is the same tool our experts use to calculate deferrable taxes when selling a. How do we report the exchange? Download the free like kind exchange worksheet. How do we report the exchange?

Download The Free Like Kind Exchange Worksheet.

How do we report the exchange? See an example scenario and download the form and instructions from the irs. The form 8824 is divided into four. How do we report the exchange?

The Form 8824 Is Divided Into Three.

If the property described on line 1. Use parts i, ii, and iii of form 8824 to report each exchange of business or investment real property for real property of a like kind. This 1031 calculator is the same tool our experts use to calculate deferrable taxes when selling a. Use part iii to figure the amount of gain required to be reported on the tax return in the current year if cash or property.