It 2663 Worksheet

It 2663 Worksheet - 16 rows combined real estate transfer tax return, credit line mortgage certificate, and certification of exemption from the payment of. Nonresident individuals, estates, and trusts are required to estimate the personal income tax liability on the gain, if any, from the sale or.

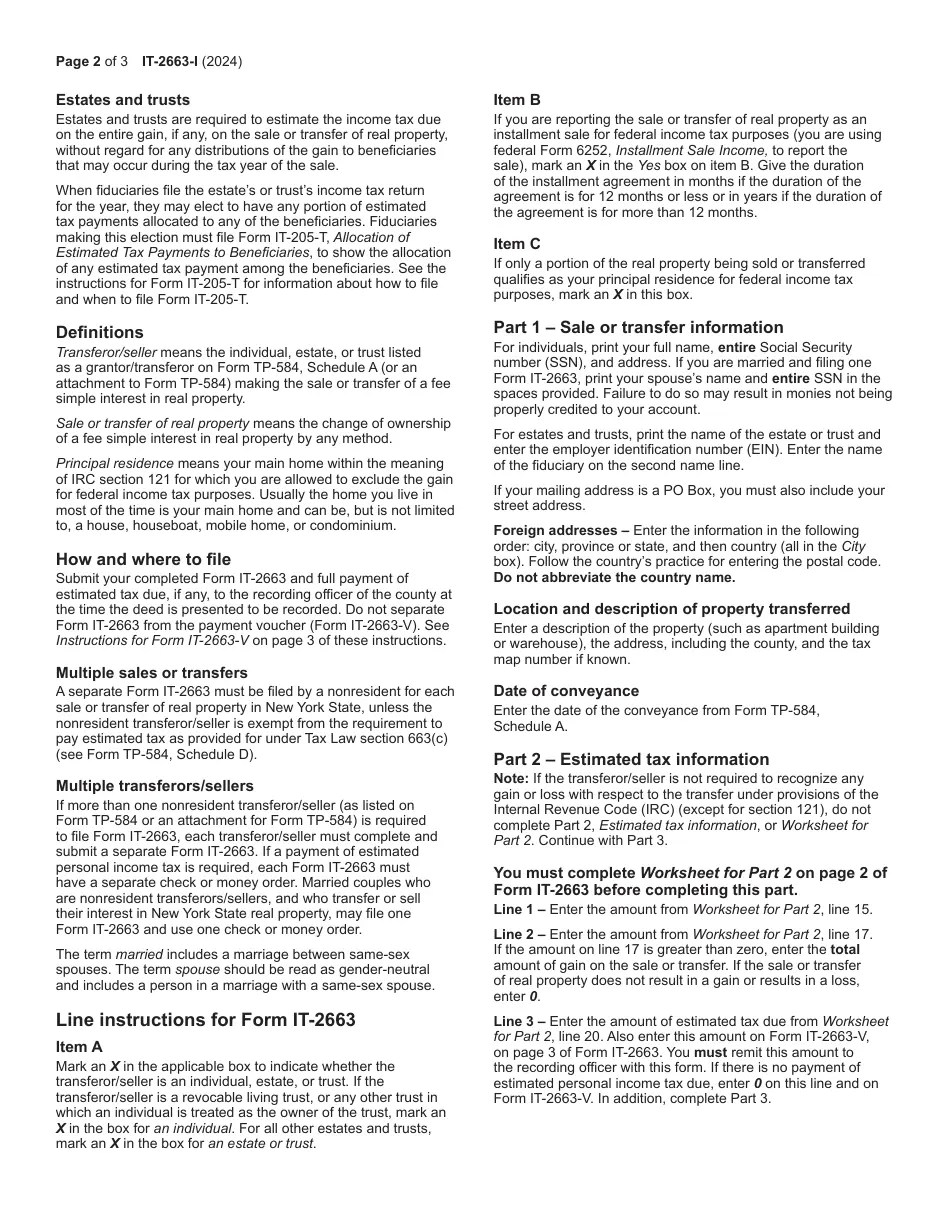

IT2663 Nonresident Real Property Estimated Tax Payment Form

Nonresident individuals, estates, and trusts are required to estimate the personal income tax liability on the gain, if any, from the sale or. 16 rows combined real estate transfer tax return, credit line mortgage certificate, and certification of exemption from the payment of.

It 2663 Fill out & sign online DocHub

16 rows combined real estate transfer tax return, credit line mortgage certificate, and certification of exemption from the payment of. Nonresident individuals, estates, and trusts are required to estimate the personal income tax liability on the gain, if any, from the sale or.

Fill Free fillable IT2663 Nonresident Real Property Estimated

Nonresident individuals, estates, and trusts are required to estimate the personal income tax liability on the gain, if any, from the sale or. 16 rows combined real estate transfer tax return, credit line mortgage certificate, and certification of exemption from the payment of.

IT2663 Nonresident Real Property Estimated Tax Payment Form

Nonresident individuals, estates, and trusts are required to estimate the personal income tax liability on the gain, if any, from the sale or. 16 rows combined real estate transfer tax return, credit line mortgage certificate, and certification of exemption from the payment of.

Integers Worksheets Absolute Values of Integers Worksheets

Nonresident individuals, estates, and trusts are required to estimate the personal income tax liability on the gain, if any, from the sale or. 16 rows combined real estate transfer tax return, credit line mortgage certificate, and certification of exemption from the payment of.

Download Instructions for Form IT2663 Nonresident Real Property

Nonresident individuals, estates, and trusts are required to estimate the personal income tax liability on the gain, if any, from the sale or. 16 rows combined real estate transfer tax return, credit line mortgage certificate, and certification of exemption from the payment of.

DBT Worksheets Worksheets Library

16 rows combined real estate transfer tax return, credit line mortgage certificate, and certification of exemption from the payment of. Nonresident individuals, estates, and trusts are required to estimate the personal income tax liability on the gain, if any, from the sale or.

How to Calculate & Determine Your Estimated Taxes Form 1040ES

Nonresident individuals, estates, and trusts are required to estimate the personal income tax liability on the gain, if any, from the sale or. 16 rows combined real estate transfer tax return, credit line mortgage certificate, and certification of exemption from the payment of.

It 2663 Form ≡ Fill Out Printable PDF Forms Online

Nonresident individuals, estates, and trusts are required to estimate the personal income tax liability on the gain, if any, from the sale or. 16 rows combined real estate transfer tax return, credit line mortgage certificate, and certification of exemption from the payment of.

Fill Free fillable IT2663 Nonresident Real Property Estimated

16 rows combined real estate transfer tax return, credit line mortgage certificate, and certification of exemption from the payment of. Nonresident individuals, estates, and trusts are required to estimate the personal income tax liability on the gain, if any, from the sale or.

16 rows combined real estate transfer tax return, credit line mortgage certificate, and certification of exemption from the payment of. Nonresident individuals, estates, and trusts are required to estimate the personal income tax liability on the gain, if any, from the sale or.

Nonresident Individuals, Estates, And Trusts Are Required To Estimate The Personal Income Tax Liability On The Gain, If Any, From The Sale Or.

16 rows combined real estate transfer tax return, credit line mortgage certificate, and certification of exemption from the payment of.