Form 4562 Depreciation Worksheet

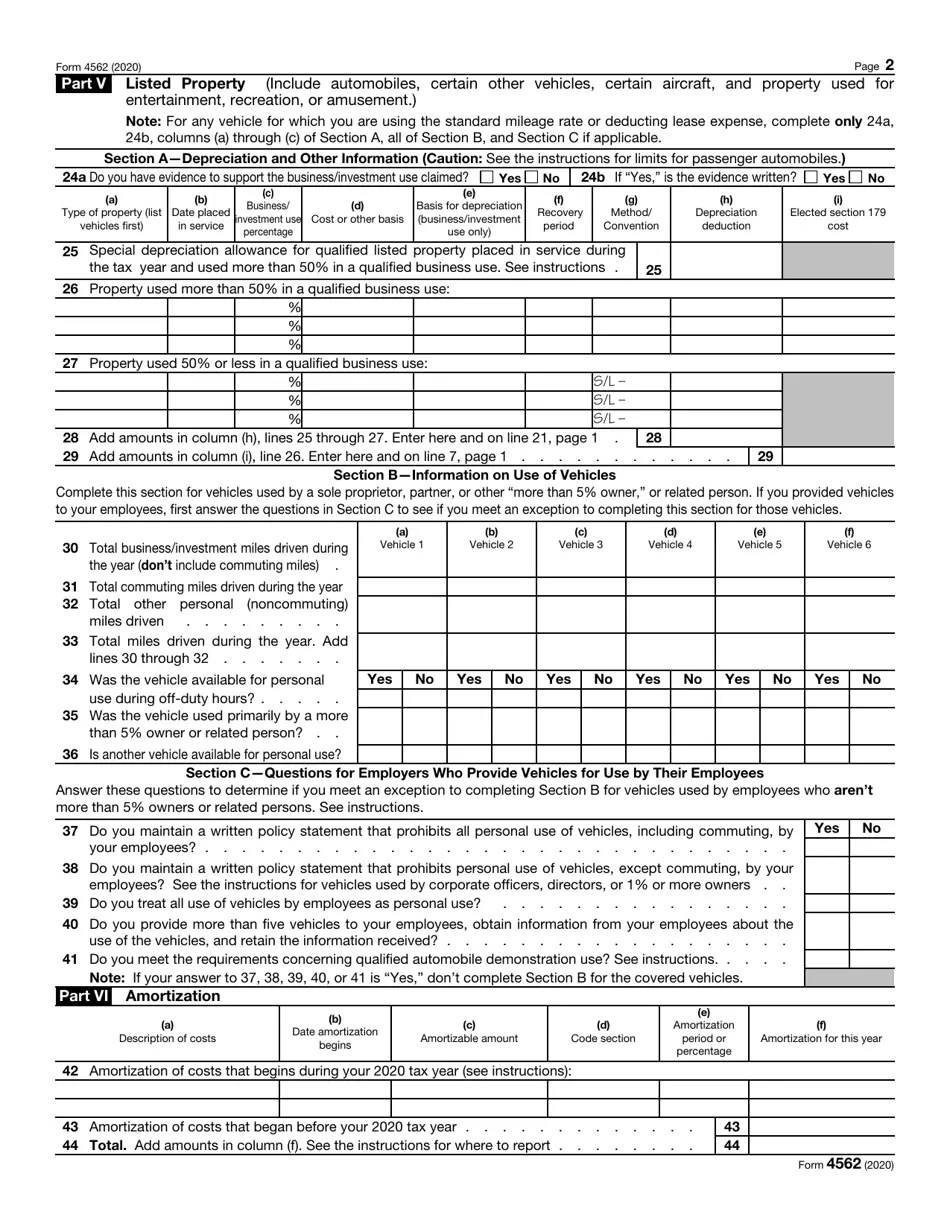

Form 4562 Depreciation Worksheet - Use irs form 4562 to claim depreciation and amortization deductions on your annual tax return. Learn how to calculate these costs, fill out the form, and file it. Make the election under section 179 to expense certain property. For any vehicle for which you are using the standard mileage rate or deducting lease expense, complete only 24a, 24b, columns (a) through (c). Small businesses use irs form 4562 to deduct yearly depreciation and amortization expenses. You may use the depreciation worksheet, later, to assist you in maintaining depreciation records. Claim your deduction for depreciation and amortization. Each year, you can use the form to deduct the cost of business property that has. The depreciation and amortization report worksheet will show the total deprecation for the property.

IRS Form 4562. Depreciation and Amortization Forms Docs 2023

For any vehicle for which you are using the standard mileage rate or deducting lease expense, complete only 24a, 24b, columns (a) through (c). Use irs form 4562 to claim depreciation and amortization deductions on your annual tax return. Small businesses use irs form 4562 to deduct yearly depreciation and amortization expenses. Claim your deduction for depreciation and amortization. The.

Form 4562 Depreciation And Amortization Worksheet

Use irs form 4562 to claim depreciation and amortization deductions on your annual tax return. Claim your deduction for depreciation and amortization. Each year, you can use the form to deduct the cost of business property that has. Make the election under section 179 to expense certain property. The depreciation and amortization report worksheet will show the total deprecation for.

Form 4562 Depreciation And Amortization Worksheet

Make the election under section 179 to expense certain property. Claim your deduction for depreciation and amortization. For any vehicle for which you are using the standard mileage rate or deducting lease expense, complete only 24a, 24b, columns (a) through (c). The depreciation and amortization report worksheet will show the total deprecation for the property. Use irs form 4562 to.

Publication 946, How To Depreciate Property; Chapter 5 Comprehensive

Claim your deduction for depreciation and amortization. Each year, you can use the form to deduct the cost of business property that has. The depreciation and amortization report worksheet will show the total deprecation for the property. For any vehicle for which you are using the standard mileage rate or deducting lease expense, complete only 24a, 24b, columns (a) through.

form 4562 depreciation and amortization worksheet Fill Online

Each year, you can use the form to deduct the cost of business property that has. For any vehicle for which you are using the standard mileage rate or deducting lease expense, complete only 24a, 24b, columns (a) through (c). Learn how to calculate these costs, fill out the form, and file it. Use irs form 4562 to claim depreciation.

IRS Form 4562 Download Fillable PDF or Fill Online Depreciation and

The depreciation and amortization report worksheet will show the total deprecation for the property. You may use the depreciation worksheet, later, to assist you in maintaining depreciation records. Use irs form 4562 to claim depreciation and amortization deductions on your annual tax return. For any vehicle for which you are using the standard mileage rate or deducting lease expense, complete.

IRS Form 4562 Instructions Depreciation & Amortization

The depreciation and amortization report worksheet will show the total deprecation for the property. Small businesses use irs form 4562 to deduct yearly depreciation and amortization expenses. Each year, you can use the form to deduct the cost of business property that has. For any vehicle for which you are using the standard mileage rate or deducting lease expense, complete.

Cómo completar el formulario 4562 del IRS

Make the election under section 179 to expense certain property. The depreciation and amortization report worksheet will show the total deprecation for the property. You may use the depreciation worksheet, later, to assist you in maintaining depreciation records. Small businesses use irs form 4562 to deduct yearly depreciation and amortization expenses. For any vehicle for which you are using the.

Depreciation Worksheet Irs Master of Documents

For any vehicle for which you are using the standard mileage rate or deducting lease expense, complete only 24a, 24b, columns (a) through (c). Small businesses use irs form 4562 to deduct yearly depreciation and amortization expenses. Claim your deduction for depreciation and amortization. Make the election under section 179 to expense certain property. Use irs form 4562 to claim.

Form 4562 Depreciation And Amortization Worksheet

You may use the depreciation worksheet, later, to assist you in maintaining depreciation records. Claim your deduction for depreciation and amortization. Make the election under section 179 to expense certain property. Use irs form 4562 to claim depreciation and amortization deductions on your annual tax return. The depreciation and amortization report worksheet will show the total deprecation for the property.

Make the election under section 179 to expense certain property. Claim your deduction for depreciation and amortization. Each year, you can use the form to deduct the cost of business property that has. You may use the depreciation worksheet, later, to assist you in maintaining depreciation records. The depreciation and amortization report worksheet will show the total deprecation for the property. Use irs form 4562 to claim depreciation and amortization deductions on your annual tax return. Small businesses use irs form 4562 to deduct yearly depreciation and amortization expenses. For any vehicle for which you are using the standard mileage rate or deducting lease expense, complete only 24a, 24b, columns (a) through (c). Learn how to calculate these costs, fill out the form, and file it.

For Any Vehicle For Which You Are Using The Standard Mileage Rate Or Deducting Lease Expense, Complete Only 24A, 24B, Columns (A) Through (C).

You may use the depreciation worksheet, later, to assist you in maintaining depreciation records. Use irs form 4562 to claim depreciation and amortization deductions on your annual tax return. Learn how to calculate these costs, fill out the form, and file it. Each year, you can use the form to deduct the cost of business property that has.

Claim Your Deduction For Depreciation And Amortization.

Small businesses use irs form 4562 to deduct yearly depreciation and amortization expenses. Make the election under section 179 to expense certain property. The depreciation and amortization report worksheet will show the total deprecation for the property.