Form 2441 Credit Limit Worksheet

Form 2441 Credit Limit Worksheet - Child and dependent care expenses as a stand alone tax form calculator to quickly calculate specific. In this article, we’ll help you break down everything you need to know about irs form 2441, including: How to complete this tax form Form 2441 is a special form that must be filed along with your tax return to claim the child and dependent care credit. The irs allows a maximum of $3,000 for one child or $6,000 for two or more children when determining your tax credit. Use this worksheet to figure the credit you may claim for 2023 expenses paid in 2024. Enter the amount reported on your 2023 form 2441, line 3. 46 rows use tax form 2441: The credit for these expenses will be entered on your 2024. Fortunately, the internal revenue service provides tax relief in the form of the child and dependent care tax credit, which you can claim by using irs form 2441.

Credit limit worksheet form 2441 Fill out & sign online DocHub

You will use worksheet a to figure your credit on the 2023 expenses paid in 2024. How to complete this tax form In this article, we’ll help you break down everything you need to know about irs form 2441, including: It includes sections for reporting the names of persons or organizations. Fortunately, the internal revenue service provides tax relief in.

2021 Form IRS Instruction 2441 Fill Online, Printable, Fillable, Blank

Enter the amount reported on your 2023 form 2441, line 3. Child and dependent care expenses as a stand alone tax form calculator to quickly calculate specific. You will use worksheet a to figure your credit on the 2023 expenses paid in 2024. The irs allows a maximum of $3,000 for one child or $6,000 for two or more children.

Form 2441 Edit, Fill, Sign Online Handypdf

Form 2441 is a special form that must be filed along with your tax return to claim the child and dependent care credit. In this article, we’ll help you break down everything you need to know about irs form 2441, including: How to complete this tax form Enter the amount reported on your 2023 form 2441, line 3. The credit.

All About IRS Form 2441 SmartAsset

46 rows use tax form 2441: Use this worksheet to figure the credit you may claim for 2023 expenses paid in 2024. The credit for these expenses will be entered on your 2024. In this article, we’ll help you break down everything you need to know about irs form 2441, including: Form 2441 is a special form that must be.

IRS Form 2441 What It Is, Who Can File, and How To Fill it Out

You will use worksheet a to figure your credit on the 2023 expenses paid in 2024. Form 2441 is a special form that must be filed along with your tax return to claim the child and dependent care credit. Fortunately, the internal revenue service provides tax relief in the form of the child and dependent care tax credit, which you.

IRS Form 2441 ≡ Fill Out Printable PDF Forms Online Worksheets Library

Enter the amount reported on your 2023 form 2441, line 3. Form 2441 is a special form that must be filed along with your tax return to claim the child and dependent care credit. The irs allows a maximum of $3,000 for one child or $6,000 for two or more children when determining your tax credit. In this article, we’ll.

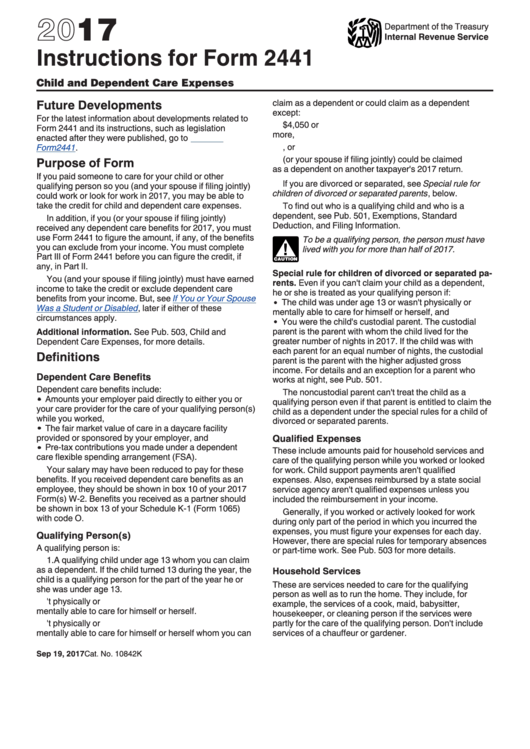

Instructions For Form 2441 Child And Dependent Care Expenses 2017

46 rows use tax form 2441: Fortunately, the internal revenue service provides tax relief in the form of the child and dependent care tax credit, which you can claim by using irs form 2441. It includes sections for reporting the names of persons or organizations. The credit for these expenses will be entered on your 2024. Child and dependent care.

IRS Form 2441 Instructions Child and Dependent Care Expenses

46 rows use tax form 2441: How to complete this tax form Fortunately, the internal revenue service provides tax relief in the form of the child and dependent care tax credit, which you can claim by using irs form 2441. Use this worksheet to figure the credit you may claim for 2023 expenses paid in 2024. In this article, we’ll.

Instructions for How to Fill in IRS Form 2441

Form 2441 is a special form that must be filed along with your tax return to claim the child and dependent care credit. Fortunately, the internal revenue service provides tax relief in the form of the child and dependent care tax credit, which you can claim by using irs form 2441. It includes sections for reporting the names of persons.

IRS Form 2441 Instructions Child and Dependent Care Expenses

Form 2441 is a special form that must be filed along with your tax return to claim the child and dependent care credit. It includes sections for reporting the names of persons or organizations. How to complete this tax form 46 rows use tax form 2441: Fortunately, the internal revenue service provides tax relief in the form of the child.

How to complete this tax form You will use worksheet a to figure your credit on the 2023 expenses paid in 2024. It includes sections for reporting the names of persons or organizations. 46 rows use tax form 2441: The credit for these expenses will be entered on your 2024. In this article, we’ll help you break down everything you need to know about irs form 2441, including: Fortunately, the internal revenue service provides tax relief in the form of the child and dependent care tax credit, which you can claim by using irs form 2441. Child and dependent care expenses as a stand alone tax form calculator to quickly calculate specific. The irs allows a maximum of $3,000 for one child or $6,000 for two or more children when determining your tax credit. Form 2441 is a special form that must be filed along with your tax return to claim the child and dependent care credit. Enter the amount reported on your 2023 form 2441, line 3. Use this worksheet to figure the credit you may claim for 2023 expenses paid in 2024.

The Credit For These Expenses Will Be Entered On Your 2024.

It includes sections for reporting the names of persons or organizations. How to complete this tax form Fortunately, the internal revenue service provides tax relief in the form of the child and dependent care tax credit, which you can claim by using irs form 2441. Use this worksheet to figure the credit you may claim for 2023 expenses paid in 2024.

Form 2441 Is A Special Form That Must Be Filed Along With Your Tax Return To Claim The Child And Dependent Care Credit.

In this article, we’ll help you break down everything you need to know about irs form 2441, including: Enter the amount reported on your 2023 form 2441, line 3. The irs allows a maximum of $3,000 for one child or $6,000 for two or more children when determining your tax credit. Child and dependent care expenses as a stand alone tax form calculator to quickly calculate specific.

46 Rows Use Tax Form 2441:

You will use worksheet a to figure your credit on the 2023 expenses paid in 2024.

:max_bytes(150000):strip_icc()/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)