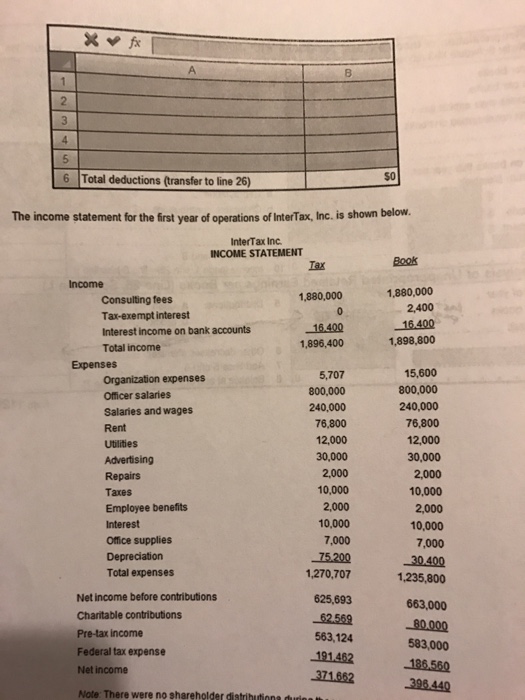

Form 1120 Line 26 Other Deductions Worksheet

Form 1120 Line 26 Other Deductions Worksheet - These statements break down and. Corporations, including certain organizations such as banks, insurance companies, and other financial institutions, must file form 1120 to report their annual income, deductions, gains,. You need to download the 1120s module. Certain irs income tax returns include federal supporting statements that serve to itemize deductions. Enter dividends received by the corporation, as well as special deductions, on screen c. Unfortunately you aren't going to find an 1120s form in the 1040 module. Affected corporations must also include an amount of estimated tax penalty on line 34 of form 1120 (or other appropriate line of the. Form 1120 dividends, inclusions, and special deductions (see instructions) dividends and (b) % (c) special deductions inclusions (a) × (b). Per irs instructions, proconnect tax generates a statement for form 1120, line 26, listing all allowable deductions that aren't.

Form 1120FSC (Rev. December 2016) irs Fill out & sign online DocHub

Unfortunately you aren't going to find an 1120s form in the 1040 module. Enter dividends received by the corporation, as well as special deductions, on screen c. Form 1120 dividends, inclusions, and special deductions (see instructions) dividends and (b) % (c) special deductions inclusions (a) × (b). You need to download the 1120s module. Per irs instructions, proconnect tax generates.

Form 1120 Other Deductions Statement Form

Per irs instructions, proconnect tax generates a statement for form 1120, line 26, listing all allowable deductions that aren't. Corporations, including certain organizations such as banks, insurance companies, and other financial institutions, must file form 1120 to report their annual income, deductions, gains,. Form 1120 dividends, inclusions, and special deductions (see instructions) dividends and (b) % (c) special deductions inclusions.

Form 1120s Other Deductions Worksheet 2019

Certain irs income tax returns include federal supporting statements that serve to itemize deductions. Affected corporations must also include an amount of estimated tax penalty on line 34 of form 1120 (or other appropriate line of the. Corporations, including certain organizations such as banks, insurance companies, and other financial institutions, must file form 1120 to report their annual income, deductions,.

Form 1120 Other Deductions Worksheet

Unfortunately you aren't going to find an 1120s form in the 1040 module. Form 1120 dividends, inclusions, and special deductions (see instructions) dividends and (b) % (c) special deductions inclusions (a) × (b). Affected corporations must also include an amount of estimated tax penalty on line 34 of form 1120 (or other appropriate line of the. Enter dividends received by.

Ird 1120 Fillable Form Printable Forms Free Online

Certain irs income tax returns include federal supporting statements that serve to itemize deductions. Form 1120 dividends, inclusions, and special deductions (see instructions) dividends and (b) % (c) special deductions inclusions (a) × (b). Enter dividends received by the corporation, as well as special deductions, on screen c. Corporations, including certain organizations such as banks, insurance companies, and other financial.

Form 1120 How to Complete and File 1120 Tax Form

Enter dividends received by the corporation, as well as special deductions, on screen c. You need to download the 1120s module. Certain irs income tax returns include federal supporting statements that serve to itemize deductions. Corporations, including certain organizations such as banks, insurance companies, and other financial institutions, must file form 1120 to report their annual income, deductions, gains,. Form.

Irs Form 1120s Other Deductions Worksheet

You need to download the 1120s module. Affected corporations must also include an amount of estimated tax penalty on line 34 of form 1120 (or other appropriate line of the. Corporations, including certain organizations such as banks, insurance companies, and other financial institutions, must file form 1120 to report their annual income, deductions, gains,. Certain irs income tax returns include.

Form 1120 S Other Deductions Worksheet

These statements break down and. Unfortunately you aren't going to find an 1120s form in the 1040 module. Certain irs income tax returns include federal supporting statements that serve to itemize deductions. Enter dividends received by the corporation, as well as special deductions, on screen c. Affected corporations must also include an amount of estimated tax penalty on line 34.

Other Deductions Form 1120s

Per irs instructions, proconnect tax generates a statement for form 1120, line 26, listing all allowable deductions that aren't. Unfortunately you aren't going to find an 1120s form in the 1040 module. Corporations, including certain organizations such as banks, insurance companies, and other financial institutions, must file form 1120 to report their annual income, deductions, gains,. You need to download.

Form 1120 Other Deductions Statement Form

Form 1120 dividends, inclusions, and special deductions (see instructions) dividends and (b) % (c) special deductions inclusions (a) × (b). Certain irs income tax returns include federal supporting statements that serve to itemize deductions. Unfortunately you aren't going to find an 1120s form in the 1040 module. These statements break down and. Corporations, including certain organizations such as banks, insurance.

Corporations, including certain organizations such as banks, insurance companies, and other financial institutions, must file form 1120 to report their annual income, deductions, gains,. You need to download the 1120s module. Affected corporations must also include an amount of estimated tax penalty on line 34 of form 1120 (or other appropriate line of the. Enter dividends received by the corporation, as well as special deductions, on screen c. Per irs instructions, proconnect tax generates a statement for form 1120, line 26, listing all allowable deductions that aren't. Unfortunately you aren't going to find an 1120s form in the 1040 module. These statements break down and. Certain irs income tax returns include federal supporting statements that serve to itemize deductions. Form 1120 dividends, inclusions, and special deductions (see instructions) dividends and (b) % (c) special deductions inclusions (a) × (b).

Unfortunately You Aren't Going To Find An 1120S Form In The 1040 Module.

Enter dividends received by the corporation, as well as special deductions, on screen c. Per irs instructions, proconnect tax generates a statement for form 1120, line 26, listing all allowable deductions that aren't. Affected corporations must also include an amount of estimated tax penalty on line 34 of form 1120 (or other appropriate line of the. Form 1120 dividends, inclusions, and special deductions (see instructions) dividends and (b) % (c) special deductions inclusions (a) × (b).

You Need To Download The 1120S Module.

These statements break down and. Corporations, including certain organizations such as banks, insurance companies, and other financial institutions, must file form 1120 to report their annual income, deductions, gains,. Certain irs income tax returns include federal supporting statements that serve to itemize deductions.