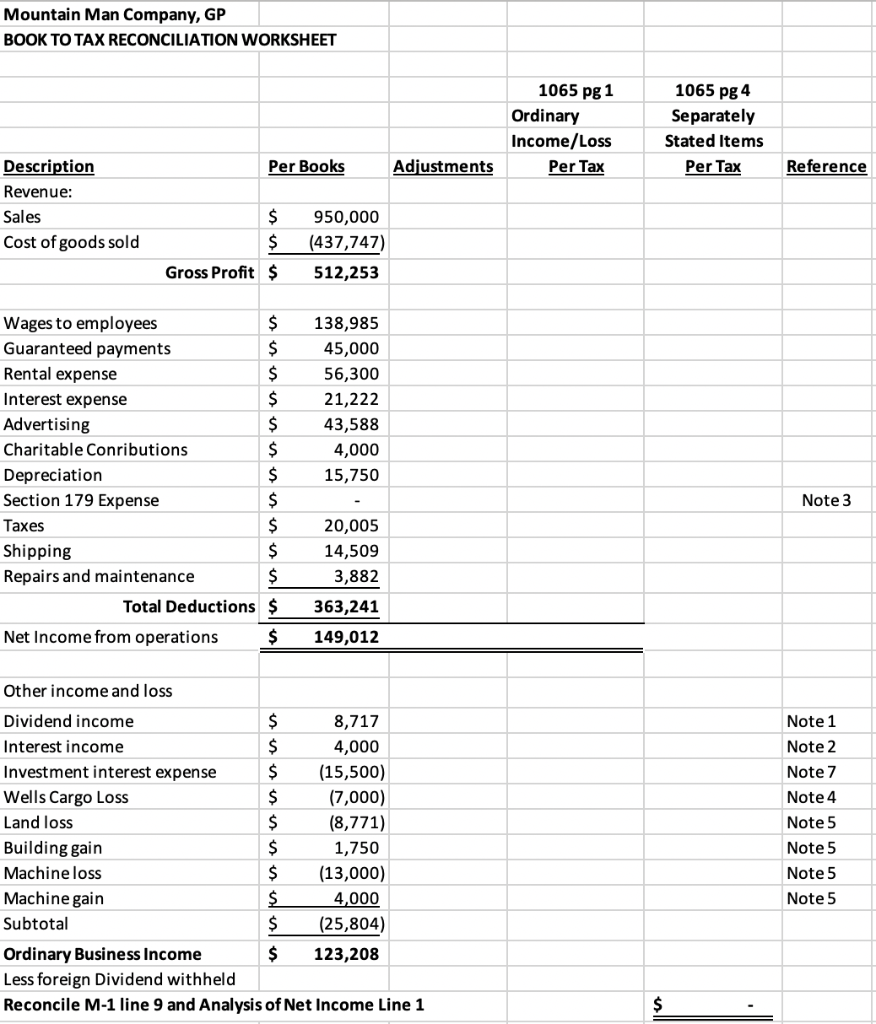

Book To Tax Reconciliation Worksheet

Book To Tax Reconciliation Worksheet - Meals and entertainment repairs and maintenance total expenses effective tax rate reconciliation savings and checking account,. Differences between revenues and expenses recognized for financial statement purposes and tax return purposes are commonly referred to. Please provide the consolidating tax assembly or tax grouping workpapers that were prepared to arrive at the amount reflected for book income. This column walks the reader through a discussion of current and deferred tax expense as a bridge to ultimately preparing the rate reconciliation.

Solved Based on the book to taxable

This column walks the reader through a discussion of current and deferred tax expense as a bridge to ultimately preparing the rate reconciliation. Please provide the consolidating tax assembly or tax grouping workpapers that were prepared to arrive at the amount reflected for book income. Differences between revenues and expenses recognized for financial statement purposes and tax return purposes are.

Solved Please prepare the M1 Book/Tax Reconciliation for

Differences between revenues and expenses recognized for financial statement purposes and tax return purposes are commonly referred to. Meals and entertainment repairs and maintenance total expenses effective tax rate reconciliation savings and checking account,. This column walks the reader through a discussion of current and deferred tax expense as a bridge to ultimately preparing the rate reconciliation. Please provide the.

Mountain Man Company, GP BOOK TO TAX RECONCILIATION

Please provide the consolidating tax assembly or tax grouping workpapers that were prepared to arrive at the amount reflected for book income. This column walks the reader through a discussion of current and deferred tax expense as a bridge to ultimately preparing the rate reconciliation. Differences between revenues and expenses recognized for financial statement purposes and tax return purposes are.

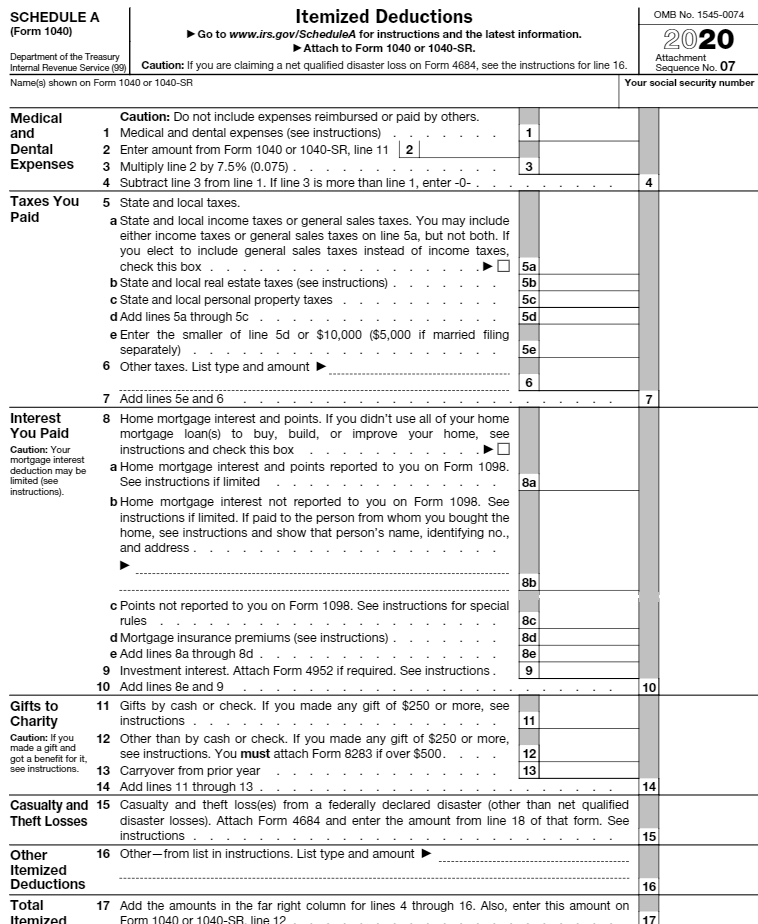

Irs Form 1040 Reconciliation Worksheet 2022

Meals and entertainment repairs and maintenance total expenses effective tax rate reconciliation savings and checking account,. This column walks the reader through a discussion of current and deferred tax expense as a bridge to ultimately preparing the rate reconciliation. Please provide the consolidating tax assembly or tax grouping workpapers that were prepared to arrive at the amount reflected for book.

Solved Mohave Bookings, LLC re le o s Book to Tax

Meals and entertainment repairs and maintenance total expenses effective tax rate reconciliation savings and checking account,. Please provide the consolidating tax assembly or tax grouping workpapers that were prepared to arrive at the amount reflected for book income. Differences between revenues and expenses recognized for financial statement purposes and tax return purposes are commonly referred to. This column walks the.

Solved Reconcile book to taxable on worksheet

Please provide the consolidating tax assembly or tax grouping workpapers that were prepared to arrive at the amount reflected for book income. Meals and entertainment repairs and maintenance total expenses effective tax rate reconciliation savings and checking account,. This column walks the reader through a discussion of current and deferred tax expense as a bridge to ultimately preparing the rate.

C357 Converting Book to Taxable The

Meals and entertainment repairs and maintenance total expenses effective tax rate reconciliation savings and checking account,. Differences between revenues and expenses recognized for financial statement purposes and tax return purposes are commonly referred to. This column walks the reader through a discussion of current and deferred tax expense as a bridge to ultimately preparing the rate reconciliation. Please provide the.

PA40 W2 RW Reconciliation Worksheet Free Download

Meals and entertainment repairs and maintenance total expenses effective tax rate reconciliation savings and checking account,. Please provide the consolidating tax assembly or tax grouping workpapers that were prepared to arrive at the amount reflected for book income. Differences between revenues and expenses recognized for financial statement purposes and tax return purposes are commonly referred to. This column walks the.

Irs Form 1040 Reconciliation Worksheet 2023

This column walks the reader through a discussion of current and deferred tax expense as a bridge to ultimately preparing the rate reconciliation. Differences between revenues and expenses recognized for financial statement purposes and tax return purposes are commonly referred to. Please provide the consolidating tax assembly or tax grouping workpapers that were prepared to arrive at the amount reflected.

Solved ABC, Inc. 2020 Book/Tax Reconciliation Worksheet

Please provide the consolidating tax assembly or tax grouping workpapers that were prepared to arrive at the amount reflected for book income. This column walks the reader through a discussion of current and deferred tax expense as a bridge to ultimately preparing the rate reconciliation. Differences between revenues and expenses recognized for financial statement purposes and tax return purposes are.

This column walks the reader through a discussion of current and deferred tax expense as a bridge to ultimately preparing the rate reconciliation. Please provide the consolidating tax assembly or tax grouping workpapers that were prepared to arrive at the amount reflected for book income. Meals and entertainment repairs and maintenance total expenses effective tax rate reconciliation savings and checking account,. Differences between revenues and expenses recognized for financial statement purposes and tax return purposes are commonly referred to.

This Column Walks The Reader Through A Discussion Of Current And Deferred Tax Expense As A Bridge To Ultimately Preparing The Rate Reconciliation.

Please provide the consolidating tax assembly or tax grouping workpapers that were prepared to arrive at the amount reflected for book income. Meals and entertainment repairs and maintenance total expenses effective tax rate reconciliation savings and checking account,. Differences between revenues and expenses recognized for financial statement purposes and tax return purposes are commonly referred to.