1041 Capital Loss Carryover Worksheet

1041 Capital Loss Carryover Worksheet - Schedule d is where you. To claim a capital loss carryover, you'll need to fill out schedule d (capital gains and losses) of form 1040 (u.s. If the estate or trust incurs capital losses in the final year, use the capital loss carryover worksheet in the instructions for schedule d. Use this worksheet to figure the estate's or trust's capital loss carryovers from 2021 to 2022 if schedule d, line 20 is a loss and certain. If the estate or trust has capital losses that cannot be fully deducted in the current year due to limitations, those losses can be carried over to future tax. Find out when to use form 8949, form. Learn how to complete schedule d (form 1041) to report capital gains and losses for estates and trusts. Use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to 2023 if schedule d, line 20, is a loss and (a) the loss on.

Capital Loss Carryover From 2022 To 2023

Schedule d is where you. If the estate or trust has capital losses that cannot be fully deducted in the current year due to limitations, those losses can be carried over to future tax. Use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to 2023 if schedule d, line 20, is a loss and (a).

Capital Loss Carryover Worksheet 2021 Pdf

If the estate or trust incurs capital losses in the final year, use the capital loss carryover worksheet in the instructions for schedule d. Use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to 2023 if schedule d, line 20, is a loss and (a) the loss on. Schedule d is where you. To claim.

Fillable Online Form 1041 schedule d capital loss carryover worksheet

Learn how to complete schedule d (form 1041) to report capital gains and losses for estates and trusts. If the estate or trust incurs capital losses in the final year, use the capital loss carryover worksheet in the instructions for schedule d. Use this worksheet to figure the estate's or trust's capital loss carryovers from 2021 to 2022 if schedule.

1041 Capital Loss Carryover Worksheet 2022

Schedule d is where you. To claim a capital loss carryover, you'll need to fill out schedule d (capital gains and losses) of form 1040 (u.s. Find out when to use form 8949, form. Learn how to complete schedule d (form 1041) to report capital gains and losses for estates and trusts. If the estate or trust incurs capital losses.

Schedule D Capital Loss Carryover Worksheet Capital Loss Car

If the estate or trust has capital losses that cannot be fully deducted in the current year due to limitations, those losses can be carried over to future tax. To claim a capital loss carryover, you'll need to fill out schedule d (capital gains and losses) of form 1040 (u.s. Use this worksheet to figure the estate's or trust's capital.

1041 Capital Loss Carryover Worksheet 2021

Find out when to use form 8949, form. Schedule d is where you. If the estate or trust incurs capital losses in the final year, use the capital loss carryover worksheet in the instructions for schedule d. To claim a capital loss carryover, you'll need to fill out schedule d (capital gains and losses) of form 1040 (u.s. Use this.

1041 Capital Loss Carryover Worksheet 2022

Use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to 2023 if schedule d, line 20, is a loss and (a) the loss on. To claim a capital loss carryover, you'll need to fill out schedule d (capital gains and losses) of form 1040 (u.s. If the estate or trust incurs capital losses in the.

Capital Loss Carryover Worksheet Printable Kids Entertainment

Learn how to complete schedule d (form 1041) to report capital gains and losses for estates and trusts. If the estate or trust incurs capital losses in the final year, use the capital loss carryover worksheet in the instructions for schedule d. Use this worksheet to figure the estate's or trust's capital loss carryovers from 2021 to 2022 if schedule.

Capital Loss Carryover Worksheet Turbotax Capital Loss Carry

If the estate or trust has capital losses that cannot be fully deducted in the current year due to limitations, those losses can be carried over to future tax. Use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to 2023 if schedule d, line 20, is a loss and (a) the loss on. Schedule d.

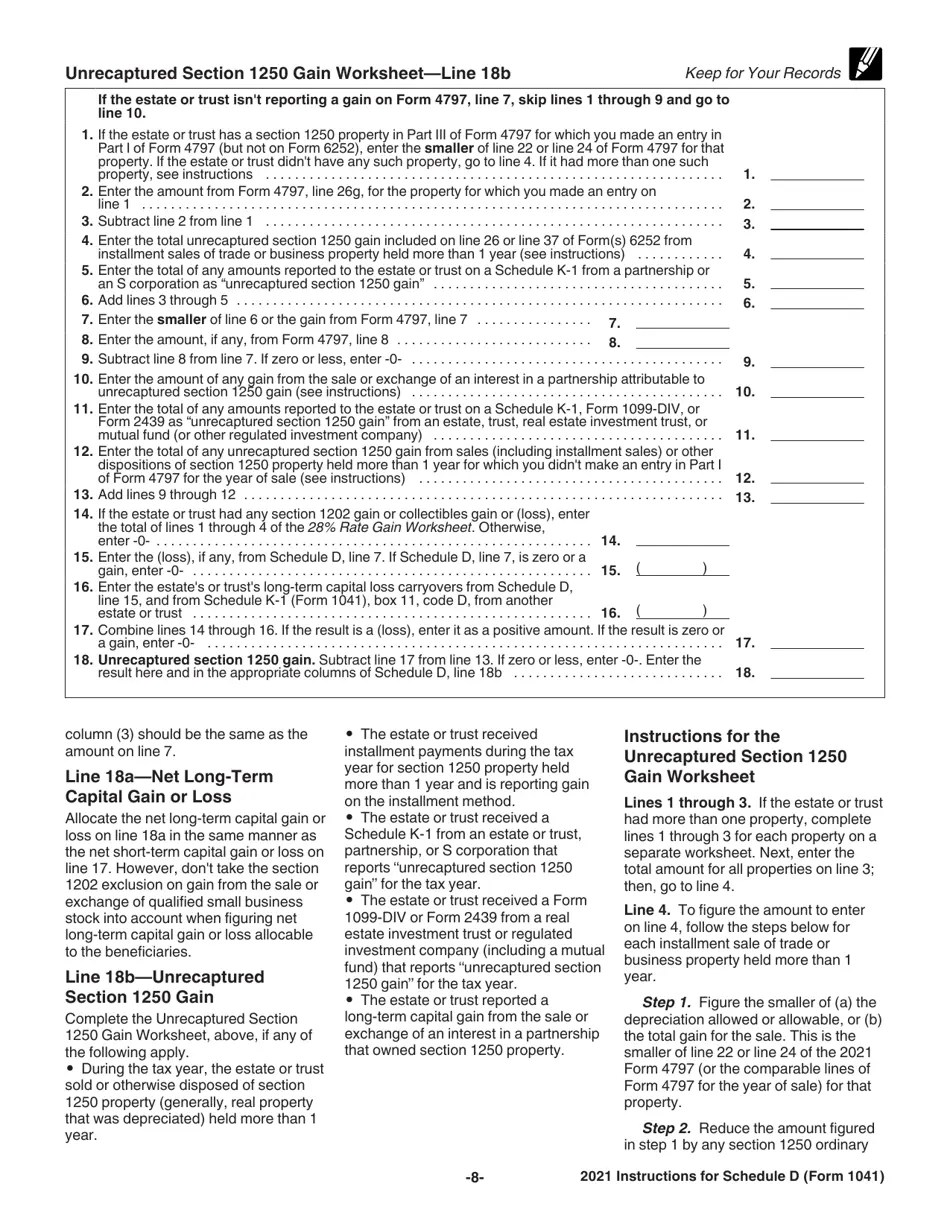

Download Instructions for IRS Form 1041 Schedule D Capital Gains and

Find out when to use form 8949, form. Use this worksheet to figure the estate's or trust's capital loss carryovers from 2021 to 2022 if schedule d, line 20 is a loss and certain. If the estate or trust has capital losses that cannot be fully deducted in the current year due to limitations, those losses can be carried over.

Schedule d is where you. Find out when to use form 8949, form. If the estate or trust has capital losses that cannot be fully deducted in the current year due to limitations, those losses can be carried over to future tax. To claim a capital loss carryover, you'll need to fill out schedule d (capital gains and losses) of form 1040 (u.s. Learn how to complete schedule d (form 1041) to report capital gains and losses for estates and trusts. Use this worksheet to figure the estate's or trust's capital loss carryovers from 2021 to 2022 if schedule d, line 20 is a loss and certain. If the estate or trust incurs capital losses in the final year, use the capital loss carryover worksheet in the instructions for schedule d. Use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to 2023 if schedule d, line 20, is a loss and (a) the loss on.

Use This Worksheet To Figure The Estate's Or Trust's Capital Loss Carryovers From 2021 To 2022 If Schedule D, Line 20 Is A Loss And Certain.

Learn how to complete schedule d (form 1041) to report capital gains and losses for estates and trusts. Use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to 2023 if schedule d, line 20, is a loss and (a) the loss on. If the estate or trust incurs capital losses in the final year, use the capital loss carryover worksheet in the instructions for schedule d. Find out when to use form 8949, form.

Schedule D Is Where You.

If the estate or trust has capital losses that cannot be fully deducted in the current year due to limitations, those losses can be carried over to future tax. To claim a capital loss carryover, you'll need to fill out schedule d (capital gains and losses) of form 1040 (u.s.