1040 Qualified Dividends And Capital Gains Worksheet

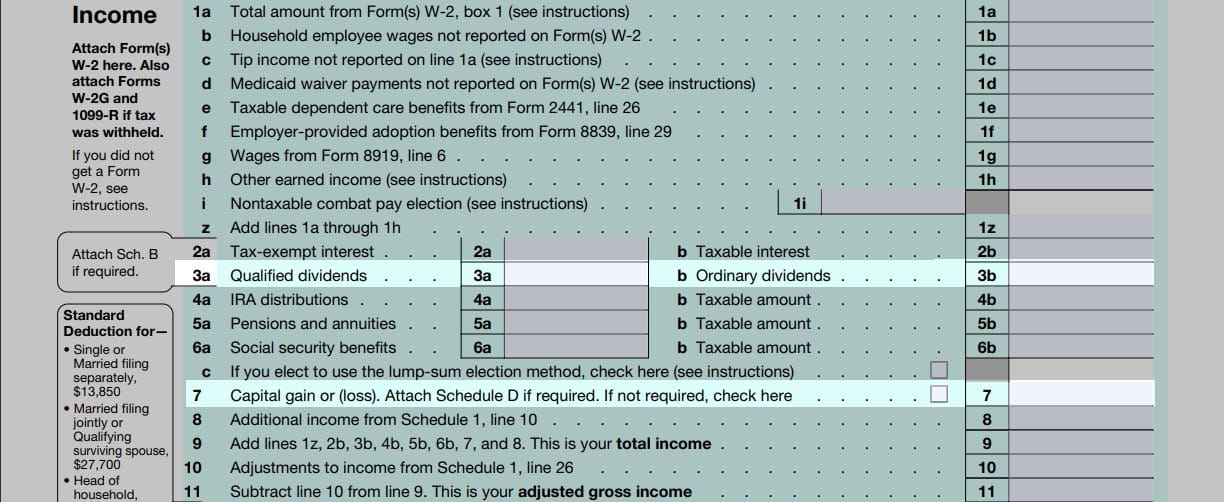

1040 Qualified Dividends And Capital Gains Worksheet - However, if you are filing form 2555 (relating to foreign earned income), enter the amount. If “yes,” attach form 8949 and see its. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of. Qualified dividends and capital gain tax worksheet—line 11a keep for your records before you begin: The qualified dividend and capital gain tax worksheet is a helpful worksheet that assists taxpayers calculate the reduced tax rate on. Note that the ordinary dividends line (3b) includes unqualified and qualified. These instructions explain how to complete schedule d (form 1040). Qualified dividends show up on line 3a of form 1040. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?

Qualified Dividends And Capital Gains Tax

If “yes,” attach form 8949 and see its. The qualified dividend and capital gain tax worksheet is a helpful worksheet that assists taxpayers calculate the reduced tax rate on. Qualified dividends show up on line 3a of form 1040. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of. Did you dispose of any investment(s).

Qualified Dividends And Capital Gains Worksheet 1040a

However, if you are filing form 2555 (relating to foreign earned income), enter the amount. Qualified dividends show up on line 3a of form 1040. The qualified dividend and capital gain tax worksheet is a helpful worksheet that assists taxpayers calculate the reduced tax rate on. Note that the ordinary dividends line (3b) includes unqualified and qualified. If “yes,” attach.

Qualified Dividends And Capital Gains 2021

The qualified dividend and capital gain tax worksheet is a helpful worksheet that assists taxpayers calculate the reduced tax rate on. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year? Note that the ordinary dividends line (3b) includes unqualified and qualified. Qualified dividends and capital gain tax worksheet—line 11a keep for your records before.

The Qualified Dividends and Capital Gains Worksheet Explained

Note that the ordinary dividends line (3b) includes unqualified and qualified. If “yes,” attach form 8949 and see its. The qualified dividend and capital gain tax worksheet is a helpful worksheet that assists taxpayers calculate the reduced tax rate on. These instructions explain how to complete schedule d (form 1040). However, if you are filing form 2555 (relating to foreign.

1040 Qualified Dividends And Capital Gains Worksheet

Qualified dividends show up on line 3a of form 1040. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of. These instructions explain how to complete schedule d (form 1040). If “yes,” attach form 8949 and see its. However, if you are filing form 2555 (relating to foreign earned income), enter the amount.

IRS Form 1040, Line 44. If you have qualified dividends, there is a 27

These instructions explain how to complete schedule d (form 1040). Qualified dividends show up on line 3a of form 1040. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year? Note that the ordinary dividends line (3b) includes unqualified and qualified. Qualified dividends and capital gain tax worksheet—line 11a keep for your records before you.

42 1040 qualified dividends and capital gains worksheet Worksheet Works

Qualified dividends show up on line 3a of form 1040. The qualified dividend and capital gain tax worksheet is a helpful worksheet that assists taxpayers calculate the reduced tax rate on. Note that the ordinary dividends line (3b) includes unqualified and qualified. However, if you are filing form 2555 (relating to foreign earned income), enter the amount. If “yes,” attach.

Easy Custom Calculator for 2023 Qualified Dividends and Capital Gain

Note that the ordinary dividends line (3b) includes unqualified and qualified. Qualified dividends and capital gain tax worksheet—line 11a keep for your records before you begin: However, if you are filing form 2555 (relating to foreign earned income), enter the amount. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of. Qualified dividends show up.

Qualified Dividends Capital Gain Tax Ws

Did you dispose of any investment(s) in a qualified opportunity fund during the tax year? Qualified dividends show up on line 3a of form 1040. The qualified dividend and capital gain tax worksheet is a helpful worksheet that assists taxpayers calculate the reduced tax rate on. These instructions explain how to complete schedule d (form 1040). Complete form 8949 before.

Qualified Dividends And Cap Gain Worksheet

The qualified dividend and capital gain tax worksheet is a helpful worksheet that assists taxpayers calculate the reduced tax rate on. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year? Note that the ordinary dividends line (3b) includes unqualified and qualified. Qualified dividends show up on line 3a of form 1040. These instructions explain.

These instructions explain how to complete schedule d (form 1040). If “yes,” attach form 8949 and see its. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of. Qualified dividends show up on line 3a of form 1040. Note that the ordinary dividends line (3b) includes unqualified and qualified. However, if you are filing form 2555 (relating to foreign earned income), enter the amount. The qualified dividend and capital gain tax worksheet is a helpful worksheet that assists taxpayers calculate the reduced tax rate on. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year? Qualified dividends and capital gain tax worksheet—line 11a keep for your records before you begin:

Qualified Dividends And Capital Gain Tax Worksheet—Line 11A Keep For Your Records Before You Begin:

The qualified dividend and capital gain tax worksheet is a helpful worksheet that assists taxpayers calculate the reduced tax rate on. However, if you are filing form 2555 (relating to foreign earned income), enter the amount. Qualified dividends show up on line 3a of form 1040. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?

Complete Form 8949 Before You Complete Line 1B, 2, 3, 8B, 9, Or 10 Of.

These instructions explain how to complete schedule d (form 1040). If “yes,” attach form 8949 and see its. Note that the ordinary dividends line (3b) includes unqualified and qualified.