1031 Exchange Calculation Worksheet

1031 Exchange Calculation Worksheet - To pay no tax when executing a 1031 exchange, you must purchase at least as much. Before preparing worksheet 1, read the attached instructions for preparation of form 8824 worksheets. This 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. A 1031 exchange is a useful tax saving tool that allows you to avoid paying capital gains taxes when you exchange an investment property used for productive use in a trade or business or for. Basis in your old property from worksheet #1 (line f) $______________ b. Then, prepare worksheet 1 after you have finished the preparation of worksheets 2.

1031 Exchange Calculation Worksheets

This 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. Before preparing worksheet 1, read the attached instructions for preparation of form 8824 worksheets. Basis in your old property from worksheet #1 (line f) $______________ b. A 1031 exchange is a useful tax saving tool that allows you to avoid paying capital gains taxes when.

1031 Exchange Worksheets 2021

This 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. Then, prepare worksheet 1 after you have finished the preparation of worksheets 2. Basis in your old property from worksheet #1 (line f) $______________ b. To pay no tax when executing a 1031 exchange, you must purchase at least as much. Before preparing worksheet 1,.

Like Kind Exchange Worksheet —

To pay no tax when executing a 1031 exchange, you must purchase at least as much. Then, prepare worksheet 1 after you have finished the preparation of worksheets 2. This 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. Before preparing worksheet 1, read the attached instructions for preparation of form 8824 worksheets. A 1031.

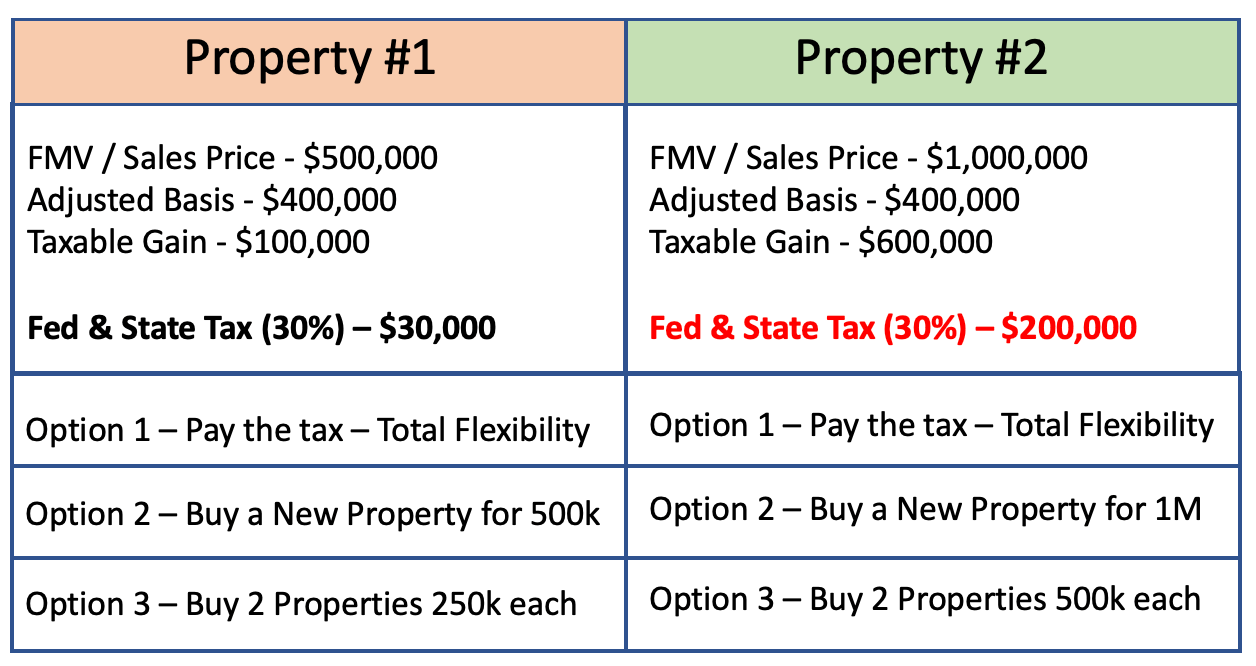

When and How to use the 1031 Exchange Mark J. Kohler

Then, prepare worksheet 1 after you have finished the preparation of worksheets 2. A 1031 exchange is a useful tax saving tool that allows you to avoid paying capital gains taxes when you exchange an investment property used for productive use in a trade or business or for. Before preparing worksheet 1, read the attached instructions for preparation of form.

1031 Exchange Calculation Worksheets

A 1031 exchange is a useful tax saving tool that allows you to avoid paying capital gains taxes when you exchange an investment property used for productive use in a trade or business or for. Before preparing worksheet 1, read the attached instructions for preparation of form 8824 worksheets. To pay no tax when executing a 1031 exchange, you must.

1031 Exchange Worksheets Excel

Then, prepare worksheet 1 after you have finished the preparation of worksheets 2. Before preparing worksheet 1, read the attached instructions for preparation of form 8824 worksheets. Basis in your old property from worksheet #1 (line f) $______________ b. A 1031 exchange is a useful tax saving tool that allows you to avoid paying capital gains taxes when you exchange.

1031 Exchange Calculation Worksheets

A 1031 exchange is a useful tax saving tool that allows you to avoid paying capital gains taxes when you exchange an investment property used for productive use in a trade or business or for. Before preparing worksheet 1, read the attached instructions for preparation of form 8824 worksheets. This 1031 exchange calculator will estimate the taxable impact of your.

Free 1031 Exchange Worksheet Excel

To pay no tax when executing a 1031 exchange, you must purchase at least as much. Basis in your old property from worksheet #1 (line f) $______________ b. Before preparing worksheet 1, read the attached instructions for preparation of form 8824 worksheets. This 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. A 1031 exchange.

Irs Calculation Of 1031 Exchange Worksheet

Before preparing worksheet 1, read the attached instructions for preparation of form 8824 worksheets. Then, prepare worksheet 1 after you have finished the preparation of worksheets 2. A 1031 exchange is a useful tax saving tool that allows you to avoid paying capital gains taxes when you exchange an investment property used for productive use in a trade or business.

1031 Exchange Worksheet Excel Master of Documents

Basis in your old property from worksheet #1 (line f) $______________ b. Then, prepare worksheet 1 after you have finished the preparation of worksheets 2. Before preparing worksheet 1, read the attached instructions for preparation of form 8824 worksheets. A 1031 exchange is a useful tax saving tool that allows you to avoid paying capital gains taxes when you exchange.

This 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. Basis in your old property from worksheet #1 (line f) $______________ b. Before preparing worksheet 1, read the attached instructions for preparation of form 8824 worksheets. To pay no tax when executing a 1031 exchange, you must purchase at least as much. A 1031 exchange is a useful tax saving tool that allows you to avoid paying capital gains taxes when you exchange an investment property used for productive use in a trade or business or for. Then, prepare worksheet 1 after you have finished the preparation of worksheets 2.

Basis In Your Old Property From Worksheet #1 (Line F) $______________ B.

Then, prepare worksheet 1 after you have finished the preparation of worksheets 2. To pay no tax when executing a 1031 exchange, you must purchase at least as much. Before preparing worksheet 1, read the attached instructions for preparation of form 8824 worksheets. This 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase.